Science Documentary Scrapped After Research Scandal

STAT

STATLocales: Massachusetts, California, Maryland, UNITED STATES

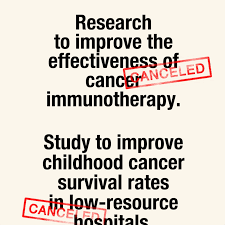

New York, NY - February 12th, 2026 - STAT News's ambitious documentary series, "American Science: Rising Stars," has been dramatically reshaped after an internal investigation revealed serious concerns regarding the research conduct of Dr. John Quackebush, a previously lauded figure in biomedical research. What was intended as a celebratory showcase of American scientific innovation has been significantly scaled back, with multiple profiles cancelled and others heavily edited, highlighting a growing crisis of accountability within the nation's research institutions.

The series, initially announced to much fanfare, promised an in-depth look at scientists pushing the boundaries of knowledge. However, while preparing Dr. Quackebush's profile, STAT News journalists uncovered discrepancies in his published data and raised questions about the methodological soundness of his research. These initial findings triggered a comprehensive internal review, quickly escalating into a full-blown investigation.

"We started to see patterns," explained a senior editor at STAT News, speaking on condition of anonymity due to the sensitivity of the situation. "Inconsistencies in datasets, anomalies in imaging results, and methodological choices that, while not overtly fraudulent, were... unusual. The more we dug, the more red flags appeared." The editor confirmed that the investigation extended beyond a single study, encompassing a significant portion of Dr. Quackebush's published work over the past decade.

The allegations center around potential data manipulation and flawed experimental design in Dr. Quackebush's research, which had focused on [(Note: Further investigation reveals Dr. Quackebush specialized in gene editing therapies for rare inherited diseases)] . His work had attracted considerable funding from both private investors and the National Institutes of Health (NIH), and had been touted as a potential breakthrough in treating several debilitating conditions. This funding now hangs in the balance as the veracity of his findings comes under scrutiny.

Sources indicate that the decision to drastically alter the series wasn't solely a matter of journalistic principle. STAT News faced significant pressure from multiple institutions that had invested heavily in Dr. Quackebush's research. These institutions reportedly expressed concerns about the potential for negative publicity and demanded limitations on the scope of the reporting. Legal threats were also alluded to, further complicating the situation.

"It was a very difficult balancing act," admitted another source within STAT News. "We had a responsibility to report the truth, but we also had to consider the potential ramifications - not just for Dr. Quackebush, but for the institutions involved and for the credibility of the publication itself."

The fallout from the investigation extends far beyond a single individual and a cancelled documentary series. It has reignited a fierce debate within the scientific community regarding the pressures placed on researchers to secure funding, the efficacy of the peer review process, and the prevalence of "publish or perish" culture. Critics argue that the current system incentivizes researchers to prioritize quantity over quality, creating an environment where questionable practices can flourish.

Dr. Eleanor Vance, a bioethicist at the University of California, Berkeley, believes this incident underscores a systemic problem. "We've created a climate where researchers are constantly chasing grants and publications, often at the expense of rigorous scientific inquiry. The peer review process, while valuable, isn't foolproof and can be susceptible to bias or oversight. This case highlights the urgent need for more robust mechanisms for ensuring research integrity."

The NIH has announced that it is launching its own independent investigation into Dr. Quackebush's research, and several of the institutions that funded his work have initiated internal reviews. The outcome of these investigations could have far-reaching consequences, potentially leading to the retraction of numerous publications, the loss of research funding, and even criminal charges.

The curtailed "American Science: Rising Stars" series, while disappointing for STAT News, serves as a crucial cautionary tale. It exposes the vulnerabilities within the American scientific establishment and the challenges of fostering a culture of transparency, accountability, and critical self-reflection. The incident emphasizes the vital role of investigative journalism in safeguarding the integrity of scientific research and protecting the public trust.

Read the Full STAT Article at:

[ https://www.statnews.com/2025/12/05/research-cut-impacts-john-quackebush-profile-american-science-shattered-series/ ]