Employer-Sponsored Health Care Costs Expected To Rise

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Employer‑Sponsored Health Care Costs Set to Rise Amid Growing Access Challenges

A recent study by the American Institute for Health Care Research (AIHR) has highlighted that the cost of employer‑sponsored health insurance is projected to climb, even as employees’ out‑of‑pocket contributions shrink. The findings, published in a comprehensive survey of more than 10,000 U.S. employers, reveal that while overall premiums are ballooning, the burden on workers may actually ease in the short term.

Rising Premiums, Falling Employee Shares

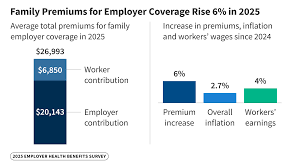

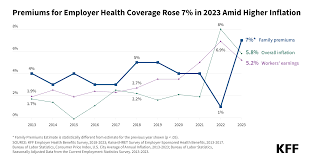

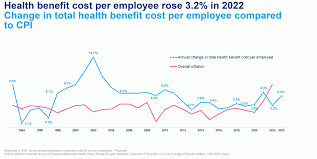

In 2023, the AIHR reported that the average total cost of employer‑sponsored health coverage increased by 8.2% for single plans and 7.9% for family plans, compared with the previous year. For a typical single employee, the average premium rose from $7,950 in 2022 to $8,600 in 2023. Family coverage costs climbed from $21,200 to $23,200 in the same period. These increases reflect a blend of rising drug prices, higher utilization of high‑tech medical services, and inflation in administrative costs.

Contrastingly, employees’ share of premiums dipped slightly. Single‑coverage employee contributions fell 1.1%, from $4,000 to $3,950. Family‑coverage employee contributions dropped 2.1%, from $9,500 to $9,320. This decline is largely attributed to employer initiatives aimed at reducing the financial strain on workers, particularly as part of broader corporate wellness programs and value‑based care models that shift some cost responsibilities to insurers rather than employees.

The Drivers Behind Cost Inflation

The AIHR report identified several key drivers of premium inflation:

Prescription Drug Costs – The cost of specialty drugs, which often treat chronic conditions such as cancer and autoimmune diseases, has surged. Prices for biologics and gene‑therapy treatments continue to climb, placing a heavier burden on insurers and, by extension, employers.

Administrative and Overhead Expenses – The shift towards high‑cost care, including advanced imaging and minimally invasive procedures, has raised administrative costs as insurers negotiate higher reimbursement rates and employers cover increased provider fees.

Workforce Demographics – Employers are increasingly hiring older employees, many of whom have pre‑existing conditions. This demographic shift drives higher risk pools and larger insurance claims.

Technological Adoption – While telehealth and digital health platforms can reduce costs in some areas, the upfront infrastructure investment and subsequent licensing fees have added to the overall expense.

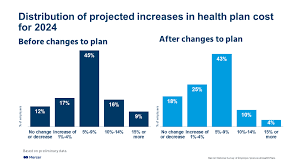

Employer Strategies to Mitigate Rising Costs

The AIHR analysis also detailed how companies are responding to the cost squeeze:

Health Savings Accounts (HSAs) and High‑Deductible Health Plans (HDHPs): Employers are more frequently pairing these to encourage employees to save for out‑of‑pocket expenses, thereby reducing premium costs.

Wellness Incentives: Corporations are offering cash bonuses, gym memberships, and smoking‑cessation programs to promote healthier lifestyles and lower long‑term health claims.

Negotiated Group Rates: Some firms are leveraging collective bargaining power to negotiate more favorable terms with insurance carriers, often securing lower premiums in exchange for higher employee contributions.

Value‑Based Care Contracts: In partnership with providers, employers are moving toward payment models that reward preventive care and outcomes, reducing costly interventions downstream.

National Impact and Policy Implications

The AIHR findings underscore the ongoing challenge of ensuring accessible health care while keeping the costs of employer‑sponsored insurance sustainable. According to the report, the average American employer spends approximately 12.5% of their total payroll on health benefits. If premiums continue to rise, many employers could face a budgetary crunch, potentially leading to reductions in benefit generosity or layoffs.

Policy analysts have pointed to the broader implications for the U.S. health care system. A 2024 article by the American Journal of Public Health highlighted how the growing cost of employer‑sponsored insurance is one of the main drivers of overall health care spending, which now exceeds 18% of GDP. Meanwhile, the Health Affairs blog has noted that employer-sponsored coverage remains the primary source of insurance for 60% of adults, making any shifts in this segment impactful for national coverage rates.

The AIHR report also references a National Bureau of Economic Research (NBER) study that examined the elasticity of employer contributions to health benefits. That study found that when employees’ share of premiums rises, firms may respond by cutting other forms of compensation, such as wages or bonuses, potentially dampening overall economic growth.

Looking Forward

In an interview with Newsweek, AIHR’s lead analyst, Dr. Eleanor Kim, emphasized that the trend of rising premiums is likely to persist over the next decade. She suggested that employers will need to continue investing in preventive health programs and exploring innovative payment models to contain costs.

The 2023 AIHR data also indicates that small businesses—defined as firms with fewer than 50 employees—are feeling the pinch more acutely. With limited bargaining power and tighter cash flows, many small firms are exploring shared benefit plans or purchasing coverage through state‑based health exchanges to mitigate the premium surge.

In summary, while employee contributions to health insurance premiums may see modest reductions, the overall cost of employer‑sponsored coverage is poised to climb, driven by drug prices, administrative costs, and changing workforce demographics. Employers are adopting a mix of high‑deductible plans, wellness initiatives, and value‑based care contracts to manage the financial pressure, but the broader implications for workforce stability, national health spending, and policy reform remain significant. The AIHR’s ongoing monitoring of these trends will be critical for stakeholders—policy makers, business leaders, and employees—who must navigate the complex landscape of health care affordability in the United States.

Read the Full Newsweek Article at:

[ https://www.newsweek.com/employer-sponsored-health-care-costs-expected-to-rise-access-health-10923267 ]