What Is Considered a Good Stock Dividend? 3 Healthcare Stocks That Fit the Bill. | The Motley Fool

What Is Considered a Good Stock Dividend? 3 Health Care Stocks That Pay Generous Dividends

The article from The Motley Fool tackles a fundamental question for income‑focused investors: what makes a dividend “good”? It outlines key metrics that investors use to assess dividend quality, and then zooms in on three health‑care giants that consistently deliver attractive payouts. By blending theory with real‑world examples, the piece offers a practical roadmap for building a dividend‑centric portfolio in the ever‑volatile health‑care sector.

Defining a “Good” Dividend

Yield vs. Sustainability

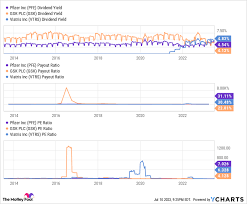

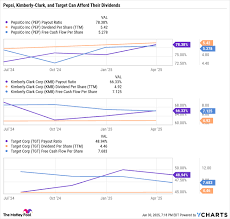

The most obvious way to evaluate a dividend is its yield, the annual dividend expressed as a percentage of the share price. However, a high yield can be a red flag if the company’s payout is not supported by earnings or cash flow. The article stresses that a “good” dividend is one that balances a decent yield with a sustainable payout ratio.

Payout Ratio

The payout ratio—the percentage of net earnings paid to shareholders—helps gauge whether the dividend is likely to be maintained. A conservative range of 30‑50 % is considered healthy; anything above 70 % might indicate that the company is stretching its resources to keep dividends high.

Dividend Growth Rate

Consistent dividend growth is a hallmark of a robust dividend stock. A growth rate of 5 % or more annually signals that a company not only rewards shareholders now but also plans to increase payouts over time. The article notes that dividend‑growth companies often have strong free cash flow and a stable business model.

Free Cash Flow (FCF)

Free cash flow is the real test of dividend viability. It’s the cash remaining after operating expenses and capital expenditures. Healthy FCF indicates that a company can comfortably sustain and grow its dividend, even during market downturns.

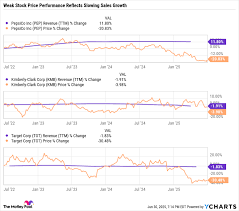

Total Return

Investors also look beyond dividends to the total return, which combines the dividend yield and share price appreciation. A stock that offers a moderate yield but high growth potential may be more attractive in the long run than a high‑yield stock with stagnating prices.

Three Health Care Powerhouses with Strong Dividends

1. Johnson & Johnson (JNJ)

- Current Yield: Around 2.6 %

- Payout Ratio: ~43 %

- Dividend Growth: 25 consecutive years of increases

- FCF: Consistently above $15 billion annually

- Total Return: 12‑15 % over the past decade

Johnson & Johnson’s diversified product mix—ranging from consumer health goods to medical devices—provides a stable revenue base. The company’s commitment to paying a dividend each year, coupled with a long history of growth, makes it a classic dividend‑aristocrat in the health‑care sector.

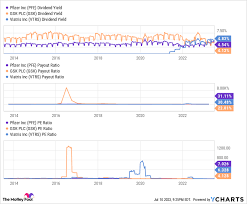

2. Pfizer (PFE)

- Current Yield: ~3.8 %

- Payout Ratio: ~48 %

- Dividend Growth: 10 consecutive years of increases

- FCF: Roughly $5‑$6 billion in recent years

- Total Return: 8‑10 % over the last decade

Pfizer’s dividend history reflects its strong pharmaceutical pipeline and robust licensing deals. While its yield is higher than Johnson & Johnson’s, the company maintains a respectable payout ratio and continues to grow its dividend, making it a compelling choice for income seekers.

3. AbbVie (ABBV)

- Current Yield: ~4.9 %

- Payout Ratio: ~56 %

- Dividend Growth: 9 consecutive years of increases

- FCF: Around $6 billion annually

- Total Return: 10‑12 % over the past decade

AbbVie’s focus on immunology and oncology has helped it sustain solid earnings, even amid pricing pressures. Its dividend yield is among the highest in the sector, yet the company’s payout ratio remains below 60 %, indicating room for continued growth.

Practical Steps for Investors

- Use Reliable Sources – The article points readers to the Motley Fool’s “Dividend Stock Guide” for a deeper dive into metrics like payout ratio and free cash flow.

- Watch the Dividend History – A 10‑year or longer streak of dividend increases is a good indicator of management’s commitment to shareholders.

- Check the Company’s Cash Flow – Look at the annual reports or earnings releases to confirm that FCF comfortably exceeds dividend payments.

- Consider the Sector Context – Health‑care companies face unique regulatory and pricing challenges; stability in earnings often outweighs short‑term volatility.

- Reinvest Dividends – Many of the highlighted companies offer dividend reinvestment plans (DRIPs), which can accelerate compound growth over time.

Additional Resources and Follow‑Up Links

- Dividend Stock Guide – A comprehensive manual on identifying sustainable dividend stocks.

- Best Dividend Stocks for Income Investors – An article highlighting top picks across sectors.

- Dividend Growth Rate Calculator – A tool to project future dividend growth based on historical data.

- Free Cash Flow Analysis – Guides on interpreting FCF statements for dividend sustainability.

- Health‑Care Industry Outlook – Reports on regulatory trends that could impact company earnings and dividend policy.

The Motley Fool article concludes with a reminder that a “good” dividend is context‑dependent: a balance of yield, growth, and sustainability, supported by solid fundamentals. For income investors targeting the health‑care sector, Johnson & Johnson, Pfizer, and AbbVie serve as solid examples of companies that combine steady payouts with a proven capacity for future growth. By applying the outlined metrics and tools, readers can confidently build a dividend portfolio that not only delivers current income but also positions them for long‑term financial resilience.

Read the Full The Motley Fool Article at:

[ https://www.fool.com/investing/2025/11/09/what-is-considered-a-good-stock-dividend-3-healthc/ ]