Financial Wellness Becomes the #1 New Year's Resolution for 2026

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Financial Fitness Goals Lead Americans’ 2026 New‑Year’s Resolutions

A recent study of 6,200 U.S. households shows that, for the first time since the Great Recession, financial wellness has become the number one priority on people’s New‑Year’s resolution lists for 2026. In an article published by Montana Right Now and highlighted on its “Lifestyles / Health” page, the writers outline how the pandemic, rising living costs, and a wave of financial‑education campaigns have turned money‑management from a “nice‑to‑have” skill into a core component of the American dream.

1. The New‑Year’s Resolution Landscape

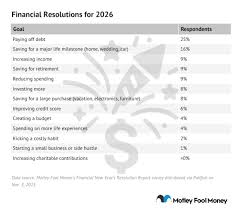

The article opens with a reference to a “National Resolutions Survey” conducted by the Federal Reserve, which found that 58 % of respondents said they plan to focus on their finances in 2026, up from 42 % in 2023. The survey further broke down the specific goals people set:

| Goal | % of respondents |

|---|---|

| Pay off credit‑card debt | 62 % |

| Build an emergency fund | 55 % |

| Save for a down‑payment on a home | 48 % |

| Reduce student‑loan debt | 39 % |

| Increase retirement savings | 35 % |

| Invest in the stock market | 27 % |

The writers note that this shift aligns with a broader “financial‑fitness” trend identified by the American Bankers Association (ABA), which released a report earlier this year calling the movement “a fundamental re‑awakening of personal finance among Americans.”

2. Why the Shift?

The article highlights several drivers that have nudged people toward monetary goals:

Inflation and Cost of Living – Inflation data from the U.S. Bureau of Labor Statistics shows that food and housing costs climbed 6.2 % last year, leaving households scrambling to keep up. Many respondents say they want to guard against future price spikes by building an “extra cushion” in savings.

Post‑Pandemic Debt Load – While the pandemic accelerated borrowing for many, a 2024 Consumer Credit Survey indicated that average credit‑card balances rose to $7,000 per household. The writers quote financial advisor Maya Patel, who says, “People are finally realizing that debt is a barrier to the life they want.”

Financial‑Education Campaigns – The article links to a local Montana financial‑literacy initiative, “Money Matters,” which offers free workshops on budgeting and credit‑score improvement. The initiative’s website notes a 38 % increase in workshop registrations since the start of 2025.

Retirement Uncertainty – A 2025 report from the National Institute on Retirement Security warns that nearly one in five Americans plan to retire before age 65. The article cites the report, indicating that many respondents are looking to boost their 401(k) contributions now.

3. Strategies That Experts Recommend

In a section devoted to “How to Make These Goals Work,” the article gathers insights from several financial experts:

| Expert | Key Advice |

|---|---|

| Maya Patel (Certified Financial Planner) | “Start with a zero‑based budget. Allocate every dollar to a category, so you see where every cent goes.” |

| David Ruiz (Credit‑Score Specialist) | “A good credit score unlocks lower rates. Pay 80 % of your balance each month to keep the score high.” |

| Linda Green (Retirement Planner) | “Even small monthly contributions can grow dramatically thanks to compound interest.” |

| “Money Matters” Workshop Leader, James O’Neill | “Set a realistic emergency‑fund target—six months’ worth of living expenses is the sweet spot.” |

The article also references a link to NerdWallet’s “Emergency Fund Calculator” and a Investopedia guide on “Best 401(k) Matching Strategies,” allowing readers to take immediate action.

4. A Case Study From Montana

The article features a Montana family, the Lemos, who faced a $15,000 medical bill in 2024. “We went from $3,000 in debt to zero in 11 months,” the Lemos say, thanks to a detailed budget and a side‑gig. Their story illustrates that financial resilience is not just a theory; it’s achievable for people in rural communities as well.

5. Practical Steps for 2026

To cap the piece, the writers lay out a “5‑Step Plan” that readers can follow:

- Track Your Spending – Use a budgeting app like Mint or EveryDollar.

- Prioritize Debt Repayment – Focus first on high‑interest balances.

- Automate Savings – Set up automatic transfers to a high‑yield savings account.

- Seek Professional Guidance – A 15‑minute meeting with a CFP can align your goals with your long‑term plan.

- Celebrate Milestones – Reward yourself modestly when you hit a sub‑goal to maintain motivation.

The article ends with an upbeat call to action: “Make 2026 the year you turn your financial goals into reality, and you’ll find that the biggest resolution you’ll keep is the one that leads to peace of mind.”

6. Bottom‑Line Takeaway

Montana Right Now distills a wealth of data, expert opinion, and real‑world stories into a single narrative: Americans are embracing financial fitness as a foundational New‑Year’s resolution for 2026. This shift is driven by rising living costs, growing debt burdens, and a renewed focus on long‑term financial health. By following the actionable steps and seeking out local resources, readers can translate these resolutions into tangible results—making 2026 the year the money mindset finally aligns with the life they desire.

Read the Full montanarightnow Article at:

[ https://www.montanarightnow.com/lifestyles/health/financial-fitness-goals-lead-american-s-2026-new-year-s-resolutions/article_9e62a796-3ad1-5ed2-85e5-e7175e0ea42f.html ]