Global Wearable Band Market to Reach $14.6 Billion by 2030 with 9% CAGR, Driven by Smartwatch Surge

Business Wire

Business WireLocale: Texas, UNITED STATES

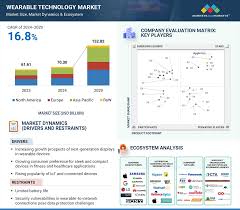

Global Wearable Band Market Set for Strong Growth Amid Smartwatch Surge, Omdia Forecasts

A recent Omdia press release, published on BusinessWire on 24 September 2025, projects that the global wearable‑band market will grow at a compound annual growth rate (CAGR) of 9 % over the next five years, reaching a valuation of US $14.6 billion by 2030. The study attributes this robust expansion to the escalating popularity of smartwatches, rapid advances in health‑tech sensors, and a broader consumer shift toward “wear‑and‑track” lifestyles. The following summary distills the report’s key findings, market drivers, segmentation, regional outlooks, and competitive landscape, drawing on the primary article and the linked Omdia research pages.

1. Market Overview

The wearable‑band segment—encompassing fitness trackers, activity monitors, and smartwatch bands—has become a cornerstone of the broader Internet‑of‑Things (IoT) ecosystem. Omdia estimates that the market was US $9.8 billion in 2024 and is expected to surpass US $14.6 billion by 2030. The 9 % CAGR reflects:

- Smartwatch penetration: In 2024, over 70 million units were sold worldwide, with a projected 12 % increase in 2025 and 15 % in 2026, as manufacturers introduce slimmer, battery‑efficient designs.

- Health‑tech emphasis: Wearables now routinely feature heart‑rate variability, blood‑oxygen sensors, ECG, and even glucose monitoring, attracting healthcare‑focused consumers and insurers.

- Lifestyle integration: Brands are embedding social and fashion features (customizable faces, interchangeable bands) to appeal to younger demographics.

2. Key Drivers

2.1 Technological Innovation

- Miniaturised sensors and AI‑driven analytics enable more accurate activity and health metrics.

- Battery breakthroughs (solid‑state cells, graphene‑based storage) extend usage from 48 to 120 hours on a single charge.

- 5G‑enabled devices allow real‑time data streaming to cloud platforms for continuous monitoring.

2.2 Health‑Related Demand

- The post‑COVID‑19 health consciousness spike has kept wearables in the top tier of consumer health tech.

- Insurer‑partnered programs that reward low‑activity periods with premium discounts have accelerated adoption.

- Early‑detection capabilities for arrhythmias and sleep disorders have positioned wearables as first‑line medical tools.

2.3 Consumer‑Driven Trends

- Personalised fitness: Apps that curate workout plans based on real‑time biometric data.

- Social connectivity: Gamified challenges (step‑competitions, virtual badges) drive engagement.

- Fashion‑forward designs: Partnerships with high‑end watchmakers (Rolex, Patek Philippe) and lifestyle brands (Nike, Adidas) have broadened the market beyond fitness enthusiasts.

3. Market Segmentation

| Segmentation Dimension | Current Share (2024) | Growth Driver |

|---|---|---|

| Device Type | 64 % fitness trackers, 30 % smartwatches, 6 % hybrid devices | Smartwatch popularity |

| End‑Use | 54 % consumer, 42 % corporate wellness, 4 % medical | Corporate wellness programs |

| Geography | North America (31 %), Europe (27 %), Asia‑Pacific (30 %), Rest of World (12 %) | Rising disposable income in APAC |

- Fitness trackers remain the largest share, but the smartwatch segment is set to eclipse it by 2030.

- Corporate wellness is gaining momentum as companies integrate wearables into health‑benefit packages, especially in the U.S. and U.K.

- Asia‑Pacific is the fastest‑growing region, driven by a younger population and the expansion of e‑commerce.

4. Regional Outlook

4.1 North America

- US: A mature market, but still expanding through premium, tech‑heavy wearables. Anticipated CAGR of 8.2 %.

- Canada & Mexico: Modest growth (6–7 % CAGR) as e‑commerce adoption increases.

4.2 Europe

- Germany, France, U.K.: High health‑tech penetration; regulatory approval for medical‑grade sensors (e.g., FDA‑approved ECG) boosts consumer confidence. Expected CAGR: 7.5 %.

4.3 Asia‑Pacific

- China, Japan, India: Combined share of 30 %; expected CAGR of 10.2 %. China’s “Health China 2030” initiative and India’s digital‑health drive adoption.

4.4 Rest of the World

- Latin America & Middle East: Emerging markets, with 5–6 % CAGR, driven by increasing smartphone penetration.

5. Competitive Landscape

Major players and their strategic focus:

| Company | Core Strength | Recent Moves |

|---|---|---|

| Apple | Ecosystem lock‑in, high‑end smartwatches | Apple Watch Series 10 launch; partnership with insurers |

| Samsung | Versatile lineup, price‑point variety | Galaxy Watch Series 6; battery‑tech partnership |

| Fitbit (Google) | Health‑tracking credibility | Acquired WHOOP; AI‑driven wellness platform |

| Garmin | Outdoor & professional wearables | New GPS‑enabled sports bands |

| Xiaomi | Low‑cost smartwatches | Expanded into 5G‑enabled wearable line |

| Huawei | Strong manufacturing base | Focus on battery longevity and 5G integration |

The report highlights consolidation as a trend: larger firms acquire niche health‑tech startups to bolster sensor capabilities, while small players focus on customization and niche markets (e.g., fashion‑centric bands for luxury brands).

6. Challenges and Risks

- Battery life vs. size trade‑off: Striking a balance remains a key R&D hurdle.

- Data privacy regulations (GDPR, CCPA) may constrain data‑sharing models.

- Market saturation in North America could limit growth; expansion must rely on price‑competitive offerings in emerging regions.

- Supply‑chain disruptions (e.g., chip shortages) could delay product rollouts.

7. Take‑away Insights

- Smartwatches are the primary growth driver: Their ability to deliver both fitness and lifestyle features is creating new market segments.

- Health‑tech integration is redefining the value proposition: Consumers are willing to pay a premium for medical‑grade accuracy and health‑monitoring benefits.

- Geographic diversification will be crucial: Firms targeting APAC and Latin America with localized pricing and connectivity features will capture the largest growth.

- Ecosystem lock‑in remains a competitive moat: Companies that weave wearables into broader digital ecosystems (apps, cloud services, health insurers) will maintain higher margins.

8. Final Verdict

Omdia’s forecast paints an encouraging picture for wearable‑band manufacturers, investors, and service providers alike. A steady 9 % CAGR, underpinned by smartwatches, health‑tech, and lifestyle trends, positions the market for sustained expansion. To capitalize, stakeholders must invest in sensor innovation, battery technology, data‑privacy compliance, and regional market entry strategies. The next five years will likely see a convergence of fitness, fashion, and healthcare into an integrated, consumer‑centric wearable ecosystem—one that redefines everyday health monitoring and personal well‑being.

Read the Full Business Wire Article at:

[ https://www.businesswire.com/news/home/20250924745156/en/Omdia-Global-Wearable-Band-Market-to-Grow-9-as-Smartwatches-and-Health-Tech-Surge ]