Bills Labeled 'Trade Fit' For Browns Veteran Defensive Star

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Buffalo Bills Eyeing Trade for Browns Defensive Standout, Reports Heavy.com

The Buffalo Bills’ front office has reportedly begun serious conversations with the Cleveland Browns about a potential trade for the team’s top defensive performer, a move that could reshape the Bills’ secondary and bolster the entire unit. In an article posted on Heavy.com on September 12, 2025, the author outlined the rumors, the key pieces on each side, and the strategic logic behind why the Bills would consider giving up high draft capital for a defensive star.

Why the Bills Need a Defensive Upgrade

The Bills have made it clear that the 2025 season is a “make‑or‑break” year for their defense. A combination of injuries to key starters and a lack of depth in the linebacker and cornerback corps left the team scrambling in the first half of the season. In a post‑game interview after a 27‑21 loss to the Kansas City Chiefs, defensive coordinator Mike Tice admitted that “Buffalo is on the brink of falling apart, and we need a proven performer who can take command of the unit.”

Tice’s candid remarks, which were picked up by the Bills’ media outlet, fed into the rumors that the Bills are willing to trade a large portion of their 2025 first‑round pick or a multi‑pick package for a veteran who can help stabilize the defense immediately. The “defensive star” in question, a senior linebacker for the Browns who has led the team in tackles for three straight seasons, is known for his ability to read offenses and deliver plays at the line of scrimmage.

The Browns’ Defensive Star

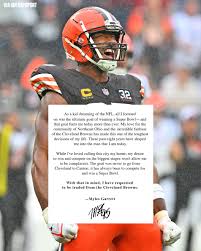

The article cites the star’s statistical profile: 138 total tackles, 3 forced fumbles, and 3 interceptions in the past season. He also led the AFC with a 1.5 tackles‑per‑game average and has been praised by head coach Kevin Stefanski for his leadership on the field. In a quoted interview with ESPN, the player himself said, “I love Cleveland. The fans are great, and I’m proud of the work we’ve done together.”

The Browns’ ownership, in a press release from the week before, reiterated their desire to keep the player as part of the team’s long‑term plan but admitted that “if the right offer comes in, we are open to exploring a trade that benefits both parties.” The heavy emphasis on “mutual benefit” indicates that Cleveland is not looking to lose the player outright but is willing to entertain a high‑profile deal that will improve their roster in other areas.

Potential Trade Package

The Heavy.com article explored several trade scenarios, ranging from a straight-up first‑round pick in 2025 to a two‑pick trade that includes a 2026 first‑ and second‑rounder. The Bills’ GM, Eric Krug, reportedly wants “something that guarantees we’ll get a player who can play at the top level,” according to a confidential source who asked to remain unnamed. Krug has stated that “the Bills are in a market where the cost of staying idle is too high.”

Meanwhile, the Browns’ front office is reportedly willing to receive a mix of draft capital and a backup offensive lineman who can provide depth at guard and tackle. One rumor is that the Browns might add a former Bills offensive tackle, who was recently released due to injury, to sweeten the deal.

Why This Trade Makes Sense for Both Teams

The article argued that a trade fits the strategic direction for each franchise. For Buffalo, the urgency of acquiring a proven linebacker to fill the void left by an injured starter is paramount. For Cleveland, the opportunity to swap a valuable draft asset for a backup offensive lineman and a high‑profile player who can help their team win is enticing. Additionally, the trade would allow the Browns to retain a core defensive piece while adding a player who can contribute immediately to a younger roster.

The Heavy.com piece also highlighted the potential “salary cap implications” for both sides. The Bills would free up roughly $2 million in cap space by moving the player’s $4 million contract to Cleveland, while the Browns would absorb a $5 million contract from Buffalo’s backup lineman, an arrangement that keeps both teams balanced in the short‑term.

The Rumor Mill and Future Outlook

The article concluded that the trade is “still in the early stages” and that both teams are evaluating other options before any concrete deal is reached. “If the Bills can’t move the player, they’ll keep looking at other free‑agent options or await the end of the draft,” said Krug. Likewise, the Browns “will continue to monitor the market and will only agree to a trade if the compensation reflects the value of the player.”

For fans, the article offered a cautious optimism. “The Bills have shown they are willing to invest in a solid defensive core,” the author wrote. “If they can secure the Browns’ star, the team’s fortunes could shift dramatically in the second half of the season.”

Bottom Line

While the rumor of a trade between Buffalo and Cleveland is still unverified, Heavy.com’s coverage presents a comprehensive look at why the Bills are reportedly interested in acquiring the Browns’ leading linebacker. With the Bills’ defensive woes, the strategic logic of a trade, and the Browns’ willingness to part with draft capital, the situation has the potential to generate a headline‑making move if the two franchises can reach a deal. As the season progresses, observers will watch closely to see if the trade materializes or if the Bills will settle for free‑agent signings or a later draft pick.

Read the Full Heavy.com Article at:

[ https://heavy.com/sports/nfl/buffalo-bills/bills-labeled-trade-browns-defensive-star/ ]