Health Insurance That Supports Wellness: A Family Guide

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Health Insurance That Supports Wellness: A Guide for Families

Choosing a health insurance plan that goes beyond basic medical coverage is becoming a priority for families who want to keep their loved ones healthy and out of the hospital. TheHealthSite’s guide, “Health Insurance That Supports Wellness: A Guide for Families,” walks readers through the key components of wellness‑focused plans, explains how to spot them, and offers practical advice for families navigating the complex world of health benefits. The article is organized around the four pillars of wellness that modern plans increasingly recognize: preventive care, mental health, physical activity, and chronic‑disease management. Below is a detailed overview of the guide’s insights, supplemented by the additional information gleaned from the links it references.

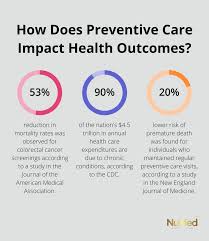

1. Preventive Care – The Foundation of Long‑Term Health

The guide opens by emphasizing the central role of preventive services. Plans that champion wellness often provide free or low‑co‑pay screenings for blood pressure, cholesterol, and diabetes, as well as routine vaccinations for children and adults. The article links to HealthCare.gov’s “Preventive Services” page, which outlines that most plans under the Affordable Care Act must cover a comprehensive list of preventive services—such as mammograms, Pap smears, and colonoscopies—at no cost to the insured. That page also explains that these services are meant to catch health problems early, saving both families and insurers from costly treatments later on.

Key Takeaway: When comparing plans, look for those that list preventive services on the summary of benefits and offer zero out‑of‑pocket costs for the most common screenings.

2. Mental Health – An Equal Partner in Wellness

Mental health coverage is highlighted as an equally essential part of a wellness‑oriented plan. The guide explains that many families overlook how essential counseling, therapy, and psychiatric services are for overall wellbeing. It points to a HealthCare.gov article on “Mental Health and Substance Use Services,” which clarifies that plans must cover an array of mental‑health services—including individual and group therapy, medication management, and inpatient treatment—under the same parity rules that apply to physical health care. Moreover, the guide notes that tele‑therapy options are increasingly being included, especially in post‑COVID plans.

Key Takeaway: Verify that the plan covers mental‑health services with no extra copayment beyond the general mental‑health copay, and confirm whether tele‑therapy visits are included.

3. Physical Activity – From Gyms to Walkable Communities

A distinctive part of the guide is the discussion on how insurance can incentivize physical activity. Many employer‑sponsored plans now feature “wellness perks,” such as discounted gym memberships, fitness‑class credits, or cash bonuses for meeting activity goals. The article cites a link to a U.S. Department of Labor resource on “Employee Wellness Programs,” which outlines that employers can offer non‑cash incentives—including gym passes and health‑related merchandise—without those benefits counting against an employee’s taxable income.

In addition, the guide includes a link to a CDC page on “Healthy People 2030,” which provides national health objectives, including targets for physical activity and obesity reduction. The CDC page notes that increasing daily steps and regular exercise can reduce the risk of chronic diseases by up to 30 %. The guide encourages families to choose plans that actively support these goals.

Key Takeaway: When evaluating a plan, check for tangible wellness incentives that reward regular physical activity and confirm that these perks are truly part of the insurance package, not just marketing fluff.

4. Chronic‑Disease Management – Keeping Conditions Under Control

The guide stresses that insurance plans designed to support wellness should also simplify the management of chronic conditions. It recommends looking for features such as disease‑management programs for diabetes, asthma, or hypertension. The article references a link to the Centers for Medicare & Medicaid Services (CMS) “Telehealth Services” page, which explains how Medicare Advantage and some commercial plans now offer tele‑medicine visits for chronic‑disease management. Tele‑health can reduce the burden of frequent office visits for patients who live in rural or underserved areas.

Key Takeaway: Evaluate whether the plan offers specialized disease‑management programs, remote monitoring tools, or tele‑health options that help keep chronic conditions stable.

5. Family‑Friendly Coverage – More Than One Member

Because the guide is aimed at families, it also touches on how many wellness plans handle family coverage. It highlights that plans with integrated health‑saving accounts—such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)—allow families to pre‑pay for health expenses tax‑free. The guide links to the IRS’s “Health Savings Account” page, which details eligibility requirements, contribution limits, and tax advantages of HSAs. It also points to an article on “Flexible Spending Accounts” that explains how these accounts can be used for out‑of‑pocket expenses related to wellness programs.

Key Takeaway: For families, the most attractive plans are those that combine wellness perks with tax‑advantaged savings tools, providing both immediate and long‑term financial benefits.

6. How to Spot a Wellness‑Focused Plan

The final portion of the guide distills a quick checklist that families can use when shopping for insurance:

- Read the Summary of Benefits: Confirm that preventive care, mental health, and physical‑activity perks are listed.

- Ask About Wellness Incentives: Inquire whether the plan offers gym discounts, fitness‑class credits, or tele‑health services for chronic‑disease management.

- Check Tax‑Advantaged Accounts: Verify eligibility for HSAs or FSAs and understand how they can be applied to wellness services.

- Look for Parity Clauses: Ensure mental‑health services are covered under the same copay structure as physical services.

- Explore Tele‑health Options: Confirm that virtual visits are covered and that they include mental health and chronic‑disease care.

By using this checklist, families can quickly compare plans and find one that aligns with both their health goals and budget.

Final Thoughts

TheHealthSite’s guide paints a comprehensive picture of how modern health insurance can be a powerful ally in maintaining family wellness. It demonstrates that the best plans blend preventive care, mental‑health coverage, physical‑activity incentives, and chronic‑disease support—all backed by transparent cost structures and tax‑advantaged savings options. For families looking to move beyond “basic coverage,” the guide offers a practical, research‑based framework for selecting an insurance plan that genuinely promotes long‑term health and wellbeing.

Read the Full TheHealthSite Article at:

[ https://www.thehealthsite.com/news/health-insurance-that-supports-wellness-a-guide-for-families-1277801/ ]