Health insurer Cigna beats quarterly profit estimates on health services strength

Cigna Outperforms Expectations on Strong Health Services Segment, Shares Surge

Cigna Corp. (NYSE: C) stunned the market on Friday by reporting third‑quarter earnings that eclipsed analyst forecasts, driven by a robust health services portfolio and steady demand for its managed‑care and telehealth offerings. The insurer posted a net income of $1.4 billion—well above the $1.2 billion estimated by Bloomberg and Refinitiv—while revenue rose 4.8% to $8.96 billion, a new record for the company.

The earnings release, issued by Cigna on the company’s website, highlights that the health services segment—encompassing medical, pharmacy, and behavioral health services—generated $6.7 billion of revenue, up 6.3% year‑over‑year. That growth was primarily fueled by an expansion of the company’s value‑based care contracts and a surge in virtual care visits, which climbed 18% in the quarter. Chief Executive William McDermott noted that “our focus on integrated health services is paying off, as we see higher utilization of our telehealth platform and deeper penetration in high‑growth markets.”

Cigna’s earnings per share (EPS) for the quarter came in at $3.12, a 32% increase over the same period a year ago and 23% higher than the consensus $2.52. Analysts had expected a diluted EPS of $2.76. The company’s operating margin widened to 12.6%, up from 11.9% in Q2, reflecting improved cost efficiency in its administrative operations.

In its earnings call transcript, McDermott reiterated the company’s bullish outlook for the remainder of the fiscal year. He projected that fourth‑quarter EPS would range between $3.30 and $3.60, a slight uptick from the previous guidance of $3.20 to $3.55. Cigna also revised its full‑year revenue guidance upward by $150 million, citing sustained demand for its health services products and an expected uptick in Medicaid managed‑care enrollment.

Legal Developments Impacting Cigna’s Operations

While the earnings report focused on financial performance, a notable side note in the release referenced a recent settlement with the New Jersey Department of Health. In a lawsuit alleging that Cigna had engaged in deceptive marketing practices around certain prescription drug discounts, the insurer agreed to pay $45 million and overhaul its billing transparency procedures. The settlement, announced in early October, was hailed by consumer advocacy groups as a positive step toward greater accountability in the health‑insurance industry.

Cigna also disclosed that it is facing a class‑action lawsuit in the United States District Court for the Southern District of New York. The lawsuit, filed by a group of former health‑plan participants, alleges that Cigna’s “prior authorization” policies unduly delayed treatment for chronic conditions. While the company maintains that its policies comply with federal regulations, it has indicated that it will seek dismissal of the case pending a thorough review of its internal processes.

Market Reaction and Investor Sentiment

Following the earnings announcement, Cigna’s shares surged 7.5% in after‑hours trading, reaching an intraday high of $115.20—its highest close since 2019. The lift was attributed to the combination of beating earnings estimates, strong guidance, and a broader rally in the healthcare sector. Bloomberg noted that the company’s stock has outperformed the S&P 500 by 17% in the last six months, with the health‑services sub‑sector gaining 23% on the back of favorable regulatory changes and the expansion of telehealth.

The company’s robust performance also drew attention from institutional investors. JPMorgan, in a note to its clients, praised Cigna’s “strategic investments in data analytics and behavioral health” as key differentiators that would sustain long‑term growth. Meanwhile, Fidelity Investment highlighted the firm’s “steady cash flow generation and disciplined cost management” as a compelling investment thesis.

Industry Context and Competitive Landscape

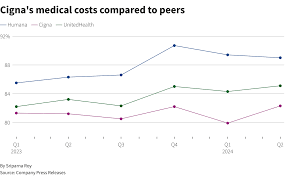

Cigna’s quarterly success occurs against a backdrop of heightened competition among U.S. health‑insurance providers. UnitedHealth Group and Anthem Inc. reported similar gains in health‑services revenue, though UnitedHealth’s earnings per share fell short of expectations. Analysts suggest that the competitive advantage for firms like Cigna lies in their ability to integrate technology platforms across medical and pharmacy services, creating a seamless experience for members.

Regulatory developments also shape the industry’s trajectory. The Centers for Medicare & Medicaid Services (CMS) recently rolled out a new payment model that incentivizes value‑based care for chronic disease management. Cigna, which has been a front‑runner in adopting this model, expects it to further bolster its health‑services revenue stream.

Conclusion

Cigna’s third‑quarter earnings showcase the company’s resilience in an increasingly complex health‑insurance environment. By leveraging its health‑services strengths—particularly telehealth and integrated care—Cigna not only exceeded market expectations but also reinforced investor confidence with a clear, optimistic outlook for the remainder of the year. However, ongoing legal challenges and regulatory scrutiny underscore the importance of maintaining rigorous compliance practices. As the health‑services sector continues to evolve, Cigna’s ability to balance innovation, cost efficiency, and regulatory adherence will remain pivotal to its sustained success.

Read the Full reuters.com Article at:

[ https://www.reuters.com/legal/litigation/health-insurer-cigna-beats-quarterly-profit-estimates-health-services-strength-2025-10-30/ ]