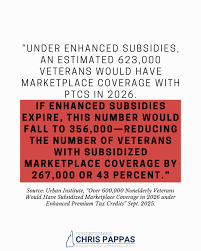

Pappas warns of rising health insurance premiums if ACA credits expire

WMUR

WMUR

Pappas Health Insurance Premiums and the ACA: What New Yorkers Need to Know

The recent wave of changes to Pappas Health Insurance plans has sparked intense discussion among New Yorkers who rely on the Affordable Care Act (ACA) marketplace for coverage. A new report from WMUR highlights how these adjustments—announced by the insurer and approved by state regulators—could affect premiums, deductibles, and the overall affordability of health care for millions of residents. Below is a comprehensive overview of the key points, contextual background, and practical implications for consumers.

The Context: Pappas Health and the ACA Marketplace

Pappas Health, a well‑established regional insurer, has long been a major player in New York’s ACA marketplace. The company offers a variety of plans—Bronze, Silver, Gold, and Platinum tiers—designed to match the needs of individuals, families, and small businesses. Historically, Pappas Health has positioned itself as a cost‑effective provider with a robust network of hospitals and primary care physicians across the state.

The ACA, enacted in 2010, created state‑run exchanges where consumers can compare plans, receive subsidies based on income, and enroll in coverage that meets federal minimums for essential health benefits. In New York, the marketplace—now branded “Health Insurance Marketplace” (NY.gov/health)—has been a critical avenue for low‑ and middle‑income households to access affordable care. Pappas Health’s presence on the exchange means that changes to its plan offerings ripple through the entire marketplace ecosystem.

The Announcement: Premium Adjustments for the 2025 Plan Year

According to WMUR’s coverage, Pappas Health will raise premiums across all tiers for the upcoming 2025 plan year. The insurer cited several factors for this increase:

Rising Medical Costs – The insurer reported higher costs for hospital stays, prescription drugs, and specialist care in 2024, particularly in the Northeast region where healthcare inflation has outpaced national averages.

Expanded Network – Pappas Health is adding new provider groups and hospital partners to its network, a move aimed at improving geographic coverage and patient choice. While this expands options for consumers, it also increases the insurer’s contractual expenses.

Regulatory Compliance – New state mandates regarding telehealth coverage and mandatory preventive services require additional administrative resources and coverage benefits.

The reported premium hikes vary by tier. For example, Bronze plans could see an average increase of 3‑5%, Silver plans 4‑6%, Gold plans 5‑7%, and Platinum plans 6‑8%. While these figures represent modest percentage increases, the absolute dollar impact can be significant, especially for lower‑income families already living near the threshold for subsidies.

The Subsidy Impact: A Double‑Edged Sword

The ACA’s premium‑tax credits help many New Yorkers offset the cost of insurance. However, when premiums rise, the amount of subsidy a consumer receives is recalculated based on the new rates. For individuals whose incomes place them just above the subsidy eligibility cutoffs (typically between 100 % and 400 % of the federal poverty level), even a small premium increase can push them beyond the subsidy threshold. This means they may have to pay a larger portion of their premiums out of pocket.

WMUR’s article emphasizes that this could be particularly problematic for families with children, retirees, and workers in the gig economy who often live on tight budgets. Pappas Health’s spokesperson, who chose to remain unnamed, acknowledged that the company is “working to minimize the impact on our members” but indicated that the adjustments were unavoidable given the economic pressures on the industry.

Policy Responses and Potential Mitigations

In the wake of the announcement, several state officials have signaled that the New York Department of Financial Services (NYDFS) will review the proposed changes to ensure they comply with state and federal regulations. The NYDFS has a mandate to protect consumers from unreasonable rate hikes and to monitor insurers’ practices on the marketplace. While the agency has not yet issued any formal rulings, it has requested additional data from Pappas Health to assess the reasonableness of the increases.

Additionally, some advocacy groups, such as the New York Association of Health Plans and the Citizens for Affordable Health, have urged the insurer to provide more transparent justifications for the hikes. They argue that greater transparency could foster consumer trust and help families plan for upcoming expenses.

Consumer Strategies to Navigate the Changes

For New Yorkers facing higher premiums, several strategies can help mitigate costs:

Re‑evaluate Plan Choice – Switching from a Bronze to a Silver plan (or vice versa) may yield a better premium‑subsidy balance. Each tier has a different mix of monthly premiums, deductibles, and out‑of‑pocket maximums, so consumers should assess their typical health care usage before making a decision.

Use the Marketplace Calculator – The Health Insurance Marketplace website offers a tool that can show projected subsidies based on different plan options. This can help families forecast their net costs before enrollment.

Explore State‑Supported Programs – New York’s Medicaid expansion provides coverage for individuals up to 138 % of the federal poverty level. Those who qualify can consider whether Medicaid might be a more affordable alternative, especially if they have high medical needs.

Leverage Employer‑Sponsored Insurance – If a consumer’s employer offers health insurance, it is often cheaper than marketplace options, even for employees earning modest wages. Employers may also offer subsidies or cost‑sharing assistance.

Engage with Pappas Health Directly – Many insurers have customer service teams that can explain plan details and help consumers understand how changes will affect their premiums. Pappas Health’s representatives are reportedly available through the insurer’s website and at local consumer service centers.

The Road Ahead: What’s Next for Pappas Health and New Yorkers

Pappas Health’s premium increase is just one of several industry shifts that reflect broader trends in health care pricing. The insurer’s decision underscores the tension between expanding provider networks, maintaining compliance with evolving regulations, and keeping costs manageable for consumers. For New Yorkers, the key takeaway is that staying informed—by checking the marketplace, reviewing subsidy eligibility, and evaluating plan features—remains essential to securing affordable coverage.

As the new plan year approaches, stakeholders will continue to monitor the situation closely. The NYDFS is expected to release its review findings in the coming weeks, and consumer advocacy groups will likely push for additional transparency and consumer protections. For those currently enrolled in Pappas Health plans, the period leading up to the next open enrollment cycle will be critical for making adjustments that balance cost, coverage, and quality.

Read the Full WMUR Article at:

[ https://www.wmur.com/article/pappas-health-insurance-premiums-aca-101625/69063513 ]