[ Today @ 12:25 PM ]: TheHealthSite

[ Today @ 12:24 PM ]: Esquire

[ Today @ 11:31 AM ]: legit

[ Today @ 11:31 AM ]: HuffPost

[ Today @ 11:30 AM ]: WYFF

[ Today @ 11:27 AM ]: NPR

[ Today @ 11:26 AM ]: news4sanantonio

[ Today @ 11:26 AM ]: Patch

[ Today @ 11:25 AM ]: WCJB

[ Today @ 11:25 AM ]: TheBlast

[ Today @ 10:24 AM ]: Patch

[ Today @ 10:23 AM ]: PetHelpful

[ Today @ 10:23 AM ]: Reuters

[ Today @ 10:03 AM ]: Forbes

[ Today @ 10:03 AM ]: CNET

[ Today @ 09:23 AM ]: Parade

[ Today @ 08:23 AM ]: Reuters

[ Today @ 08:23 AM ]: Forbes

[ Today @ 07:23 AM ]: TheHealthSite

[ Today @ 07:03 AM ]: CNET

[ Today @ 05:03 AM ]: WESH

[ Today @ 04:43 AM ]: BBC

[ Today @ 04:23 AM ]: TheHealthSite

[ Today @ 04:03 AM ]: Moneycontrol

[ Today @ 03:24 AM ]: CNET

[ Today @ 03:05 AM ]: WGAL

[ Today @ 12:23 AM ]: TheHealthSite

[ Yesterday Evening ]: ESPN

[ Yesterday Evening ]: CNN

[ Yesterday Evening ]: Crash

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: WJZY

[ Yesterday Afternoon ]: People

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: CNN

[ Yesterday Afternoon ]: TheHealthSite

[ Yesterday Afternoon ]: TheHealthSite

[ Yesterday Afternoon ]: People

[ Yesterday Afternoon ]: BBC

[ Yesterday Afternoon ]: TheHealthSite

[ Yesterday Morning ]: ClutchPoints

[ Yesterday Morning ]: TheHealthSite

[ Last Saturday ]: NewsNation

[ Last Saturday ]: KOIN

[ Last Saturday ]: Parade

[ Last Saturday ]: NewsNation

[ Last Saturday ]: Prevention

[ Last Saturday ]: Uncrowned

[ Last Saturday ]: WAVY

[ Last Saturday ]: AOL

[ Last Saturday ]: Patch

[ Last Saturday ]: People

[ Last Saturday ]: TheHealthSite

[ Last Saturday ]: TheHealthSite

[ Last Saturday ]: Reuters

[ Last Saturday ]: BBC

[ Last Friday ]: ClutchPoints

[ Last Friday ]: TSN

[ Last Friday ]: Patch

[ Last Friday ]: People

[ Last Friday ]: FanSided

[ Last Friday ]: Lifehacker

[ Last Friday ]: IGN

[ Last Friday ]: fox17online

[ Last Friday ]: WGAL

[ Last Friday ]: WTVD

[ Last Friday ]: People

[ Last Friday ]: BBC

[ Last Friday ]: Prevention

[ Last Friday ]: Cosmopolitan

[ Last Friday ]: Forbes

[ Last Friday ]: Lifehacker

[ Last Friday ]: WYFF

[ Last Friday ]: TheHealthSite

[ Last Friday ]: Newsweek

[ Last Friday ]: BBC

[ Last Friday ]: BBC

[ Last Friday ]: TheHealthSite

[ Last Friday ]: stacker

[ Last Friday ]: Snopes

[ Last Friday ]: TheHealthSite

[ Last Friday ]: Prevention

[ Last Thursday ]: ClutchPoints

[ Last Thursday ]: WGME

[ Last Thursday ]: BBC

[ Last Thursday ]: ClutchPoints

[ Last Thursday ]: Newsweek

[ Last Thursday ]: UPI

[ Last Thursday ]: FanSided

[ Last Thursday ]: Cosmopolitan

[ Last Thursday ]: TheHealthSite

[ Last Thursday ]: WIFR

[ Last Thursday ]: Newsweek

[ Last Thursday ]: TheHealthSite

[ Last Thursday ]: Newsweek

[ Last Thursday ]: Forbes

[ Last Thursday ]: Lifewire

[ Last Thursday ]: MLive

[ Last Thursday ]: TheHealthSite

[ Last Thursday ]: WYFF

[ Last Thursday ]: Daily

[ Last Thursday ]: wacotrib

[ Last Thursday ]: Daily

[ Last Thursday ]: Newsweek

[ Last Thursday ]: Lifehacker

[ Last Thursday ]: Moneycontrol

[ Last Thursday ]: WESH

[ Last Thursday ]: Parade

[ Last Thursday ]: TheHealthSite

[ Last Thursday ]: Lifehacker

[ Last Wednesday ]: KKTV11

[ Last Wednesday ]: ClutchPoints

[ Last Wednesday ]: Forbes

[ Last Wednesday ]: ESPN

[ Last Wednesday ]: Kotaku

[ Last Wednesday ]: Newsweek

[ Last Wednesday ]: CNN

[ Last Wednesday ]: CNN

[ Last Wednesday ]: People

[ Last Wednesday ]: KUTV

[ Last Wednesday ]: WESH

[ Last Wednesday ]: People

[ Last Wednesday ]: Gizmodo

[ Last Wednesday ]: Today

[ Last Wednesday ]: WGNO

[ Last Wednesday ]: WFTV

[ Last Wednesday ]: WRDW

[ Last Wednesday ]: TheHealthSite

[ Last Wednesday ]: TechRadar

[ Last Wednesday ]: Forbes

[ Last Wednesday ]: People

[ Last Wednesday ]: 13abc

[ Last Wednesday ]: ABC12

[ Last Wednesday ]: WJCL

[ Last Wednesday ]: TheHealthSite

[ Last Wednesday ]: BBC

[ Last Wednesday ]: Forbes

[ Last Wednesday ]: Lifehacker

[ Last Wednesday ]: Mandatory

[ Last Wednesday ]: CNN

[ Last Wednesday ]: KIRO

[ Last Wednesday ]: Globe

[ Last Wednesday ]: TheHealthSite

[ Last Wednesday ]: BBC

[ Last Wednesday ]: Parade

[ Last Wednesday ]: MLive

[ Last Wednesday ]: MLive

[ Last Wednesday ]: WMUR

[ Last Wednesday ]: TheHealthSite

[ Last Wednesday ]: WLKY

[ Last Wednesday ]: 13abc

[ Last Tuesday ]: TheHealthSite

[ Last Tuesday ]: ClutchPoints

[ Last Tuesday ]: Upper

[ Last Tuesday ]: Talksport

[ Last Tuesday ]: Jerry

[ Last Tuesday ]: Moneycontrol

[ Last Tuesday ]: UPI

[ Last Tuesday ]: CNN

[ Last Tuesday ]: Daily

[ Last Tuesday ]: VAVEL

[ Last Tuesday ]: FanSided

[ Last Tuesday ]: BBC

[ Last Tuesday ]: Onefootball

[ Last Tuesday ]: BBC

[ Last Tuesday ]: Cosmopolitan

[ Last Tuesday ]: Prevention

[ Last Tuesday ]: deseret

[ Last Tuesday ]: BBC

[ Last Tuesday ]: Newsweek

[ Last Tuesday ]: FanSided

[ Last Tuesday ]: WPXI

[ Last Tuesday ]: Today

[ Last Tuesday ]: TheHealthSite

[ Last Tuesday ]: TheHealthSite

[ Last Tuesday ]: WDAF

[ Last Tuesday ]: KTVI

[ Last Tuesday ]: TechRadar

[ Mon, Jul 07th ]: BBC

[ Mon, Jul 07th ]: Newsweek

[ Mon, Jul 07th ]: Moneycontrol

[ Mon, Jul 07th ]: NewsNation

[ Mon, Jul 07th ]: People

[ Mon, Jul 07th ]: WGNO

[ Mon, Jul 07th ]: Newsweek

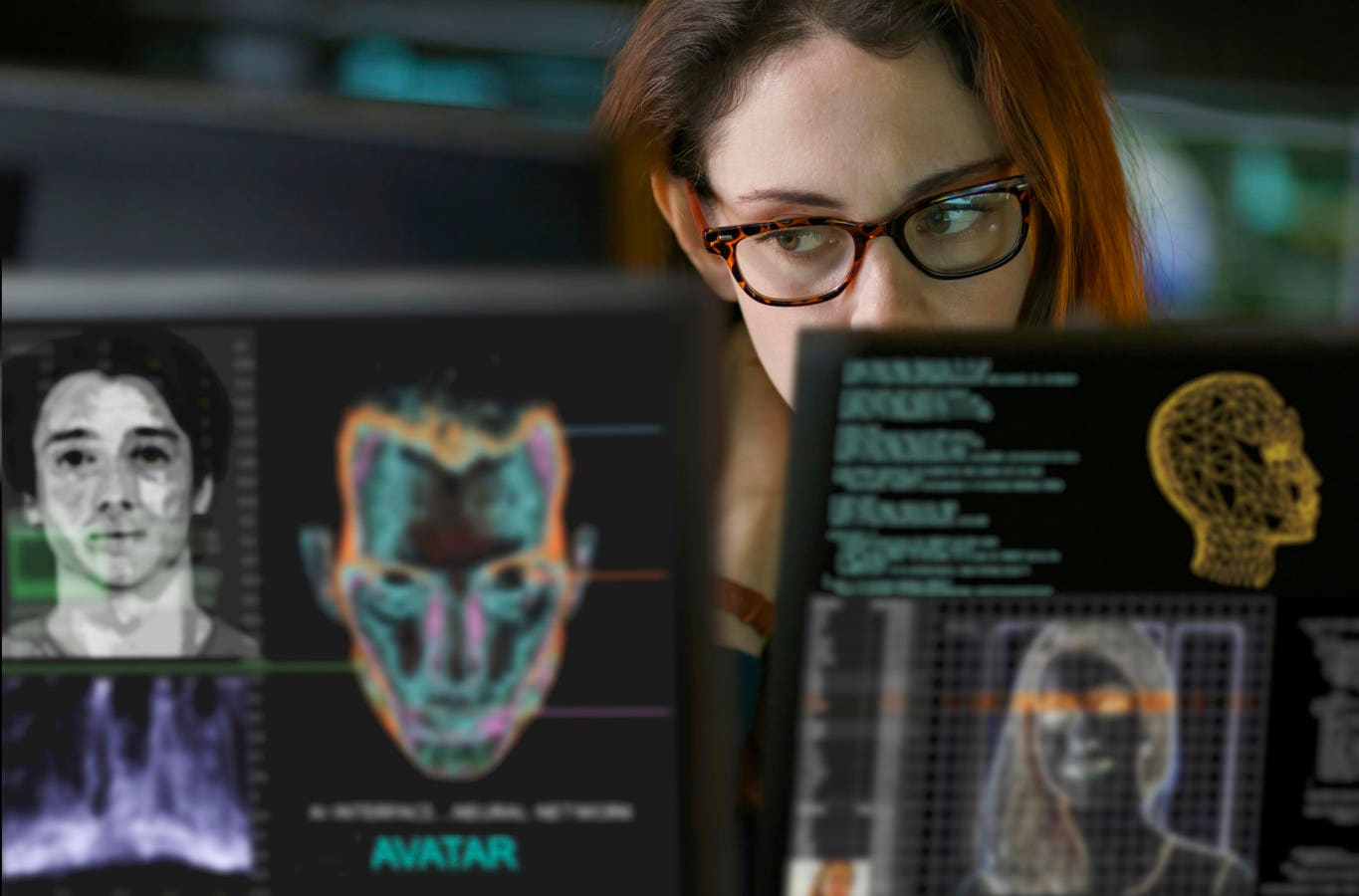

Synthetic Identity Fraud In The Age Of GenAI: Are Traditional KYC Tools Still Fit For Purpose?

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

To stay ahead, businesses must shift from passive to active verification methods.

Synthetic identity fraud, as described in the article, is a type of fraud where criminals create fictitious identities by combining real and fabricated personal information. Unlike traditional identity theft, which involves stealing an existing person’s identity, synthetic identity fraud constructs entirely new personas that often go undetected for extended periods. These fraudulent identities are used to open bank accounts, apply for credit, and engage in other financial activities, ultimately leading to significant financial losses for institutions and individuals. The article highlights that the rise of GenAI has exacerbated this issue by enabling fraudsters to generate highly realistic and convincing synthetic identities at scale. GenAI tools can produce fake documents, images, and even deepfake videos, making it increasingly difficult to distinguish between legitimate and fraudulent identities.

The author begins by outlining the scale of the problem, citing statistics and industry reports that underscore the growing prevalence of synthetic identity fraud. According to the piece, this form of fraud is one of the fastest-growing financial crimes in the United States and globally, costing businesses billions of dollars annually. The Federal Reserve has identified synthetic identity fraud as a major concern for financial institutions, as it often evades traditional detection methods. The article notes that the anonymity and scalability provided by digital platforms, combined with the power of GenAI, have created a perfect storm for fraudsters to exploit vulnerabilities in existing systems.

A significant portion of the article is dedicated to critiquing the effectiveness of traditional KYC tools in the face of these evolving threats. KYC processes, which are designed to verify the identity of customers during onboarding, typically rely on static data points such as government-issued IDs, Social Security numbers, and credit histories. While these methods were once sufficient for detecting fraud, the author argues that they are increasingly obsolete in the age of GenAI. Fraudsters can now easily forge documents or manipulate data to pass KYC checks, as GenAI tools can replicate official documents with near-perfect accuracy. Moreover, traditional KYC systems often fail to detect synthetic identities because these personas may not have a pre-existing digital footprint or credit history, which are red flags in conventional fraud detection models.

The article also discusses the limitations of manual review processes within KYC frameworks. Human reviewers, while skilled, are often overwhelmed by the sheer volume of applications and may lack the tools to identify subtle inconsistencies in synthetic identities. Additionally, manual processes are time-consuming and costly, creating friction for legitimate customers who expect seamless onboarding experiences. The author emphasizes that the balance between security and user experience is a critical challenge for businesses, as overly stringent KYC measures can deter customers, while lax processes expose organizations to fraud risks.

In response to these challenges, the article advocates for the adoption of advanced technologies to combat synthetic identity fraud. The author suggests that machine learning (ML) and artificial intelligence (AI) can play a pivotal role in enhancing fraud detection capabilities. Unlike traditional KYC tools, AI-driven systems can analyze vast amounts of data in real-time, identifying patterns and anomalies that may indicate fraudulent activity. For instance, behavioral biometrics—such as analyzing typing patterns or device usage—can provide an additional layer of verification beyond static data points. The article also highlights the potential of blockchain technology to create secure, immutable identity records that are resistant to tampering by fraudsters.

Furthermore, the author stresses the importance of collaboration between industries and regulators to address synthetic identity fraud on a systemic level. Financial institutions, technology providers, and government agencies must work together to establish standardized protocols for identity verification and data sharing. The article points to initiatives like digital identity frameworks and public-private partnerships as promising steps toward creating a more secure ecosystem. However, it also acknowledges the challenges of implementing such solutions, including concerns over data privacy and the need for global interoperability.

Another key theme in the article is the ethical implications of using AI to combat fraud. While AI offers powerful tools for detection, the author cautions against over-reliance on automated systems, which can lead to false positives and unfairly exclude legitimate customers. Ensuring fairness and transparency in AI algorithms is essential to maintain trust and avoid discrimination. The piece calls for continuous monitoring and refinement of AI models to adapt to the evolving tactics of fraudsters, as well as regular audits to address biases in the technology.

The article also touches on the role of consumer education in mitigating synthetic identity fraud. While technological solutions are critical, empowering individuals to protect their personal information is equally important. The author suggests that businesses and governments should invest in awareness campaigns to educate the public about the risks of sharing sensitive data online and the importance of monitoring financial accounts for suspicious activity.

In conclusion, the Forbes article paints a sobering picture of the challenges posed by synthetic identity fraud in the era of GenAI. It argues that traditional KYC tools, while once effective, are no longer fit for purpose in detecting and preventing this sophisticated crime. The author calls for a multi-faceted approach that combines cutting-edge technologies like AI and blockchain with industry collaboration, regulatory support, and consumer education. By embracing innovation and adapting to the changing threat landscape, businesses can better protect themselves and their customers from the devastating impacts of synthetic identity fraud. The piece serves as both a warning and a call to action, urging stakeholders to rethink their strategies and invest in future-proof solutions to safeguard the integrity of digital identities.

This summary, spanning over 900 words, captures the core arguments, insights, and recommendations presented in the article, providing a comprehensive overview of the critical issues surrounding synthetic identity fraud and the evolving role of KYC tools in the age of GenAI.

Read the Full Forbes Article at:

[ https://www.forbes.com/councils/forbesbusinessdevelopmentcouncil/2025/07/14/synthetic-identity-fraud-in-the-age-of-genai-are-traditional-kyc-tools-still-fit-for-purpose/ ]